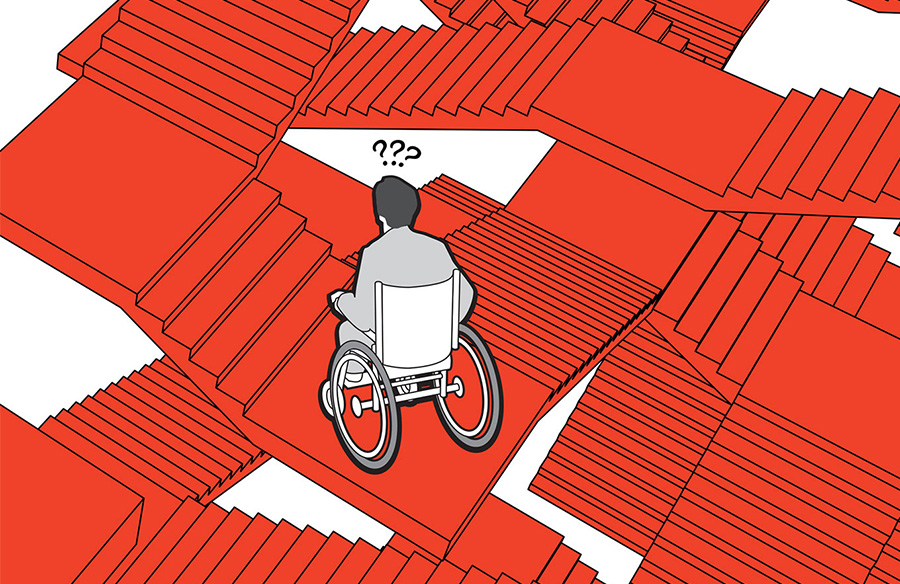

How Does Architecture Address The Needs Of Differently Abled Individuals?

As per the Indian income tax laws, individuals with disabilities or differently-abled individuals can avail tax deductions under Section 80U. This section was introduced to provide financial relief to disabled individuals who may incur extra expenses due to their physical limitations.

What is Section 80U?

Section 80U is a provision in the Indian Income Tax Act that allows individuals with disabilities to claim tax deductions. The tax deduction is available to both resident and non-resident individuals with disabilities. To claim deductions under this section, the individual must be certified as disabled by a medical authority notified by the government.

Who is Eligible for Deductions Under Section 80U?

To be eligible for tax deductions under Section 80U, an individual must meet the following conditions:

- The individual must be certified as disabled by a medical authority

- The individual must be a resident of India

- The individual must have a valid Disability Certificate issued by a medical authority notified by the government

How Much Tax Deduction is Allowed under Section 80U?

The tax deduction allowed under Section 80U depends on the degree of disability and the age of the individual. For individuals with disabilities between 40% and 80%, a tax deduction of Rs 75,000 is allowed. For individuals with disabilities over 80%, a tax deduction of Rs 1,25,000 is allowed. The tax deduction is available from the financial year 2020-21 onwards.

Documents Required to Claim Tax Deductions under Section 80U

To claim tax deductions under Section 80U, an individual must submit the following documents:

- Disability Certificate issued by a notified medical authority

- Proof of medical expenses incurred for the treatment of the disability

How to Claim Tax Deductions under Section 80U?

To claim tax deductions under Section 80U, an individual must file their income tax return and provide the details of the deductions claimed under the relevant section. The individual must attach the Disability Certificate issued by a notified medical authority and proof of medical expenses incurred for the treatment of the disability.

FAQ: Frequently Asked Questions

Q: Is the tax deduction available only to individuals with disabilities or can their family members claim the deduction?

A: The tax deduction is available only to the individual with the disability and not to their family members.

Q: What is the validity of the Disability Certificate?

A: The validity of the Disability Certificate is generally for a period of 5 years from the date of issue. However, the validity may vary depending on the severity of the disability and the discretion of the medical authority.

Q: Can an individual claim tax deductions under both Section 80U and 80DD?

A: No, an individual cannot claim tax deductions under both Section 80U and 80DD. The tax deduction is allowed only under one section.

Q: What is the procedure for getting a Disability Certificate?

A: To obtain a Disability Certificate, an individual must approach a notified medical authority and undergo a medical examination. The medical authority will assess the individual's disability and issue the Disability Certificate accordingly.

Q: Is the tax deduction available to non-resident individuals with disabilities?

A: Yes, the tax deduction is available to both resident and non-resident individuals with disabilities.

Q: Can an individual claim tax deductions for expenses incurred on the treatment of disabilities?

A: Yes, an individual can claim tax deductions for expenses incurred on the treatment of disabilities. The expenses must be supported by proper receipts and bills.

Conclusion

Section 80U provides crucial financial assistance to individuals with disabilities who may incur extra expenses due to their physical limitations. With the tax deductions available under this section, disabled individuals can reduce their tax liability and ease their financial burden. It is advisable for disabled individuals to obtain a Disability Certificate and claim tax deductions as per the provisions of Section 80U.

Post a Comment for "How Does Architecture Address The Needs Of Differently Abled Individuals?"